How to Track Stock Watchlist News in One Place (Without Opening 10 Tabs)

Cut through the noise and surface up insights that actually matter

If you actively research stocks, this scenario probably feels uncomfortably familiar...

You open your watchlist.

Click into a ticker.

Open Google News.

Then Yahoo Finance.

Then Seeking Alpha.

Then earnings transcripts.

Then Reddit.

Then X (Twitter).

Before you know it, you’re staring at 10+ browser tabs for a single stock — and somehow you still aren’t confident you have the full picture.

This isn’t because you’re a bad investor.

It’s not because you’re undisciplined.

It’s because modern stock research is fragmented by design.

Every platform gives you a piece of the story, but none give you the full, trusted, and current context in one place.

That’s exactly the problem Watchlist Brief by Value Hunter is built to solve.

In This Article (TL;DR)

We’ll cover:

🧠 Why modern stock research creates unnecessary cognitive load

📚 How information overload reduces signal clarity

🛡️ Why trust and recency are harder than ever to assess

➡️ A before vs. after stock research workflow

🗂️ How Watchlist Brief becomes a trusted aggregation layer

The Real Problem Isn’t Information — It’s Fragmentation ⚠️

We live in an era of information abundance.

There is no shortage of stock market news, earnings reports, analyst opinions, financial commentary, social sentiment

Yet investors feel less confident than ever.

Why?

Because critical stock information is scattered across disconnected platforms, each optimized for different incentives.

For every stock, investors are forced to:

- Search multiple financial news platforms

- Cross-check similar headlines for credibility

- Guess whether articles are outdated

- Decide which sources are trustworthy

This fragmentation compounds quickly per ticker:

- 10 stocks → dozens of browser tabs

- 25 stocks → research becomes exhausting

- 50+ stocks → decision quality declines

At scale, this isn’t research.

It’s context switching.

Context Switching: The Hidden Cost of Stock Research

Context switching occurs when your brain constantly shifts between tools, layouts, and narratives.

In investing, this looks like: Reading the same earnings story rewritten five different ways ⮕ Jumping between bullish and bearish opinions ⮕ Then eventually losing track of what actually matters

Each switch introduces:

- Mental fatigue

- Reduced insight retention

- Slower decision-making

- Higher emotional bias

Most stock research platforms force context switching instead of eliminating it.

Too Much Noise, Not Enough Signal 📢

Another core issue is headline overload.

Not all news deserves equal attention — but most platforms treat it that way.

Investors regularly encounter:

- Minor updates framed as “breaking news”

- Rehashed press releases across multiple outlets

- Opinion pieces mixed with factual updates

The result?

High-impact signals get buried under low-impact noise.

Traditional tools push the burden of filtering and prioritization onto the investor.

Can You Trust What You’re Reading?

Even after opening multiple tabs, a deeper question remains:

Is this information accurate, current, and credible?

Investors today face:

- Conflicting interpretations of the same event

- Out of date articles appearing high in your search results

- Click-optimized content lacking substance

To compensate, investors:

- Read multiple versions of the same story

- Cross-reference sources manually

- Delay decisions until confidence improves

Ironically, this verification loop is what causes tab overload.

Before Watchlist Brief: The Traditional Research Workflow ❌

The traditional stock research process usually looks like this:

- Start with a ticker

- Search for the latest stock news

- Open Google News

- Open Yahoo Finance

- Open Seeking Alpha

- Skim Reddit and X

- Compare overlapping headlines

- Manually synthesize insights

This workflow is:

- Time-consuming

- Mentally exhausting

- Error-prone

- Impossible to scale

Now repeat that for every stock in your watchlist.

After Watchlist Brief: One Ticker. One View. Full Context. ✅

Watchlist Brief fundamentally changes this workflow.

Instead of hunting for information, the information comes to you — already organized and contextualized.

With Watchlist Brief, each ticker includes:

- A single, unified news stream per stock

- The most recent and impactful updates

- Articles grouped by relevance and theme

- Clear source attribution

- Reduced duplication through aggregation

You are no longer asking:

“Have I read enough?”

What Is Watchlist Brief?

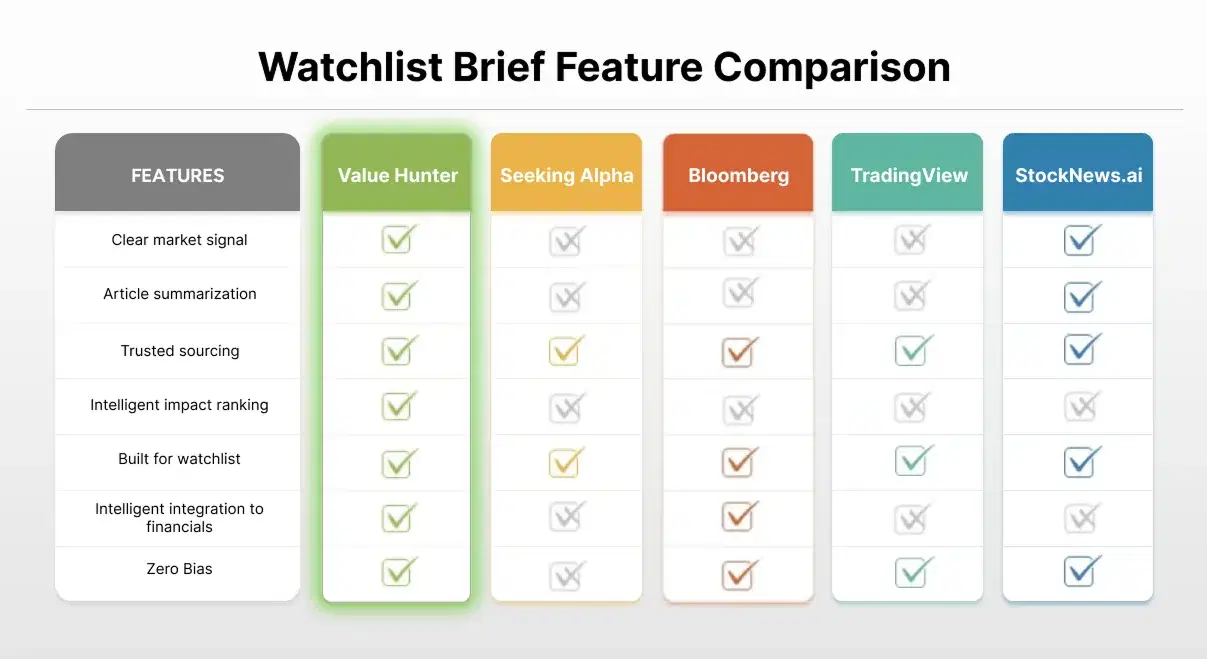

Watchlist Brief is a ticker-centric news aggregation feature inside Value Hunter.

It is designed for investors managing multiple stocks who want faster stock research with less noise. Bringing you confidence in your trades.

Rather than showing raw headlines, Watchlist Brief aggregates news by ticker. We are able to assess for repetitive headlines and consolidate it. We also highlight the new development with directed signals like (Bullish, Bearish or Neutral) allowing for clear interpretation of the news - no need for the guess work. The beauty of this aggregation is that you can set a time frame (1-5 days), on how far back you want to go in your research.

It’s not just a news feed.

It’s a context engine for equity research.

How Watchlist Brief Becomes Your Trusted Source Layer

Most financial platforms optimize for engagement.

Watchlist Brief optimizes for clarity and trust.

Ticker-Centric Aggregation

News is organized around the stock — not the publisher.

Source Transparency

Trusted sources include: Reuters, Bloomberg, MarketWatch, CNBC, Benzinga, Forbes, Financial Times

Recency Clarity

You immediately know what’s new and what’s outdated.

Signal Over Noise

Duplicate and low-impact headlines are consolidated into themes.

Why Aggregation Is a Structural Advantage 📈

Aggregation isn’t a shortcut.

It removes structural inefficiencies from stock research.

When friction is removed:

- Research time per stock decreases

- Cognitive load drops

- Confidence increases

- Watchlists scale effortlessly

Instead of finding information, investors focus on interpreting insights.

Why This Matters More Than Ever

Markets move faster.

Content volume keeps growing.

Attention is limited.

The best investors aren’t those who read the most.

They’re the ones who see clearly.

In modern markets, clarity is alpha.

Stop Chasing Tabs. Start Seeing Signal.

If your stock research requires:

- Dozens of browser tabs

- Re-reading the same stories

- Constant source verification

The problem isn’t your discipline.

It’s your tools.

Watchlist Brief is designed to be:

- Your trusted source

- Your noise filter

- Your research command center

Next Step: Experience Watchlist Brief 🚀

If you want to:

- Reduce stock research time

- Eliminate context switching

- Trust the information you read

- Scale your watchlist with confidence

👉 Try Value Hunter's Watchlist Brief and experience how Watchlist Brief transforms stock research.