Best Stock News Analysis Tools Compared

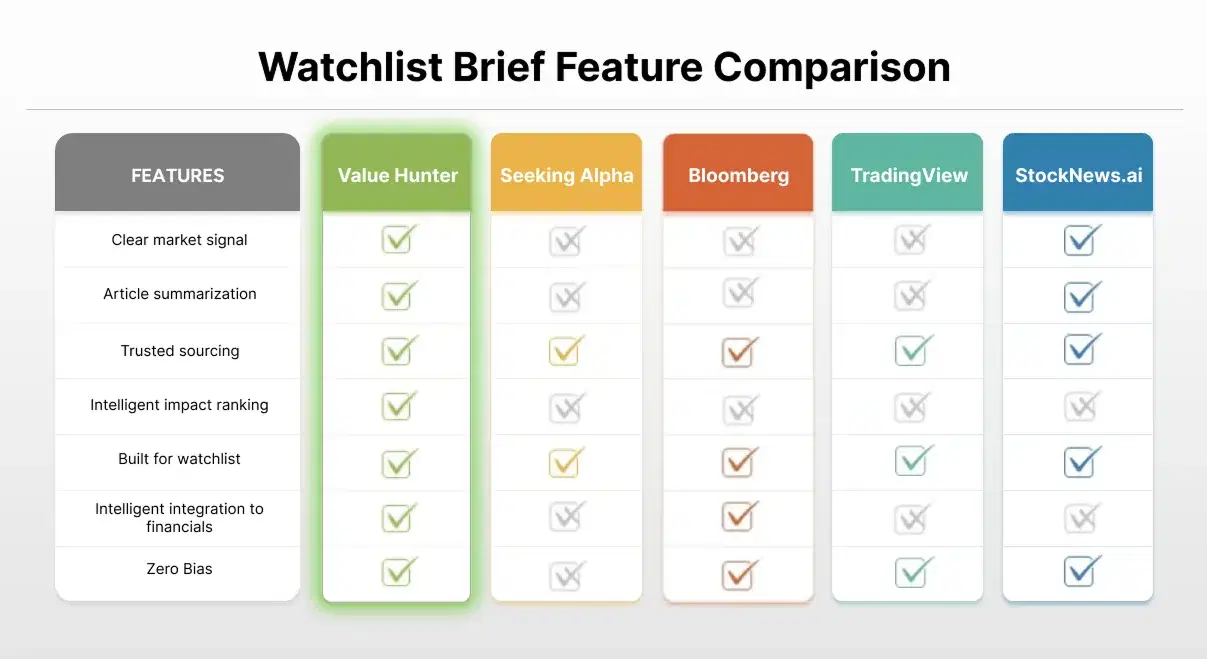

Comparing stock watchlist news tools? See how Value Hunter’s Watchlist Brief stacks up against Bloomberg, Seeking Alpha, TradingView, and more—across features, speed, trust, and signal.

The Real Job to Be Done: From Headlines to Signal

Before comparing tools, let's clarify the actual problem investors are trying to solve.

Most investors don’t struggle with a lack of information. They struggle with filtering, speed, and knowing which news actually matters for the stocks they follow.

What they actually want is a simpler and intuitive experience: relevant news tied directly to their watchlist, a clear understanding of what matters and why, fast awareness without sacrificing accuracy, and context that connects today’s events to a company’s historical fundamentals.

This article compares today’s most popular stock news and analysis tools. What they do well, where they fall short, and which type of investor each one is best suited for.

By the end you will know exactly which tool fits your workflow and why.

My Evaluation Categories for Stock News & Analysis Tools

- Speed of material news delivery

- Signal to noise ratio

- Ticker-level relevance

- Workflow efficiency

- Time-to-insight

⚖️ Tool Comparison

Bloomberg: Powerful, but Built for Institutions

Outdated user experience easily causing cognitive overload

Their Approach

Bloomberg is unmatched in breadth. It offers comprehensive market coverage, watchlist-driven feeds, and decades of historical data. However, its core assumption is that the user will perform the synthesis themselves.

Where it falls short

- No AI-generated summaries per stock

- No bullish/bearish signaling

- No automated context tied to company fundamentals

- Extremely high cost and steep learning curve

Who is this tool best suited for?

Very sophisticated and highly trained investing professional, who is able to properly synthesize and distill raw information down to a clear signal and strategy.

Value Hunter's Watchlist Brief takes the opposite approach: interpretation over volume, relevance over raw access, and speed without institutional complexity.

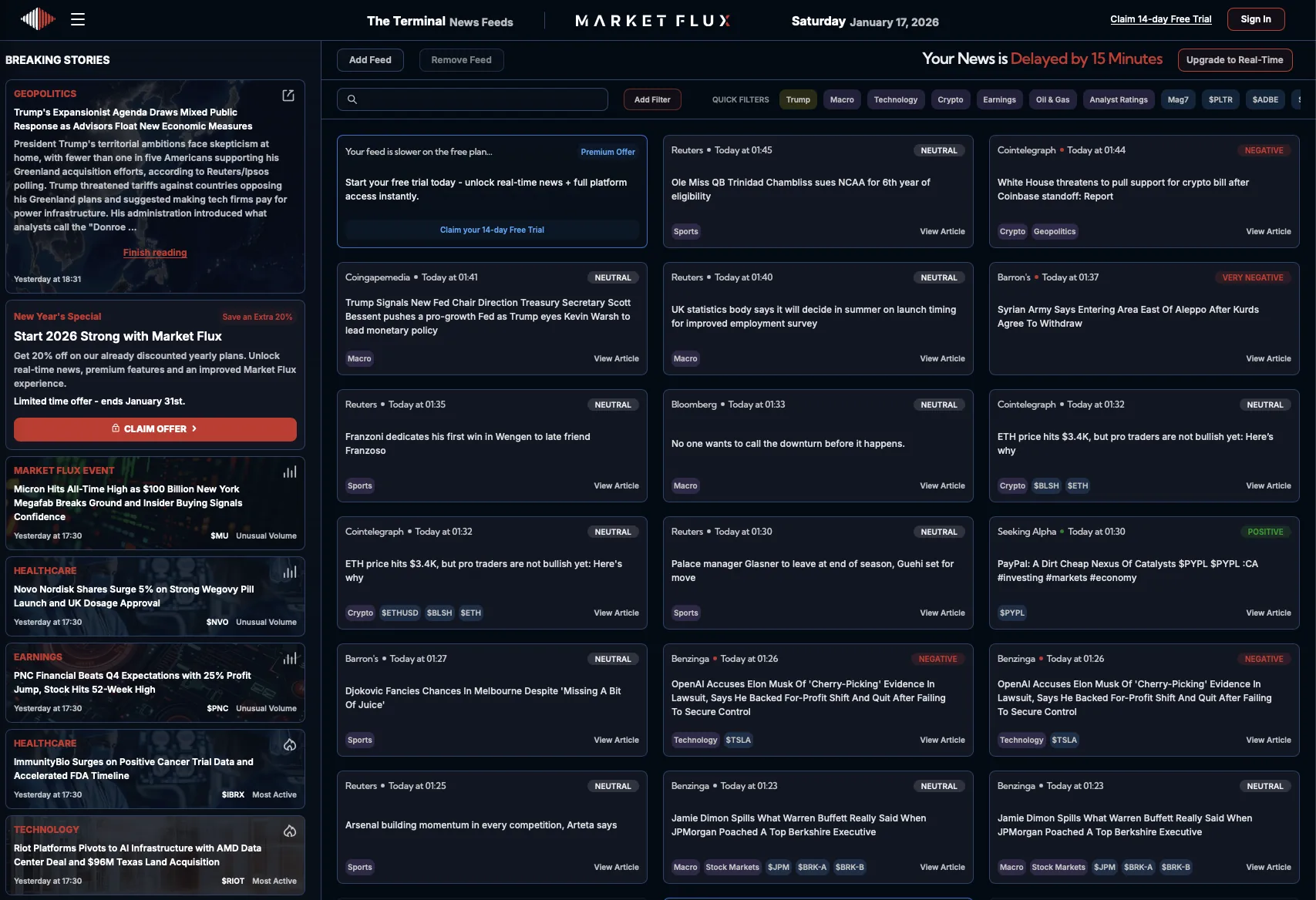

MarketFlux: Noise Over Signal

Busy interface without a clear signal or indication of where to focus user's attention, often relying on untrusted source

Their Approach

- Aggregates content from many sources

- Pulls heavily from X (Twitter)

Where it falls short

- Busy, cluttered interface

- Little prioritization of what actually matters

- Social media signals introduce speculation and noise

Treating social media sentiment as a trusted signal introduces bias and speculation, making it difficult to distinguish real company-impacting events from market chatter. For serious investors, more content does not equal better insight.

Who is this tool best suited for?

Individuals who follow finance influencers for their investment decisions or investors that appreciates a different angle/opinion

Value Hunter's Watchlist Brief intentionally filters for credible sources, structured data, and company-specific relevance—without forcing users to wade through sentiment-driven noise.

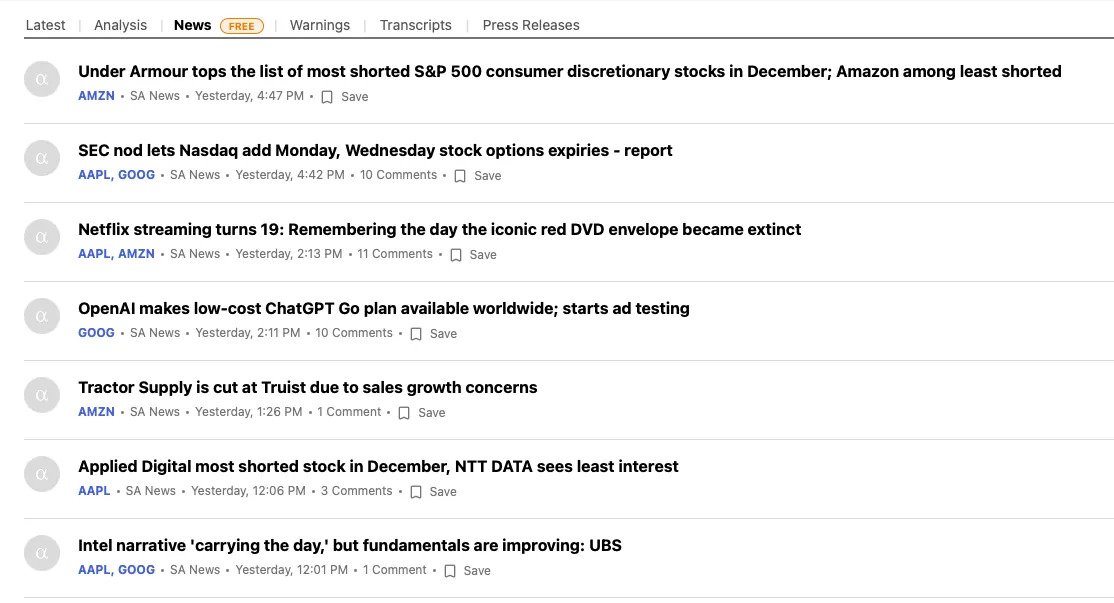

Seeking Alpha: Opinion-Led and Often Late

Only curates articles written by Seeking Alpha

Seeking Alpha is well known for its deep fundamental articles and analyst commentary. The issue is structural: news only surfaces after someone from Seeking Alpha decides to write about it.

Their Approach

- In-depth fundamental articles

- Analyst commentary

- Stock-specific coverage

Where they fall short

- News only appears after an article is written

- If no analyst covers the event, you may never see it

- Frequent delays for breaking developments

- Heavy bias toward the author’s interpretation

In effect, you’re tracking what someone chose to write about, not what’s happening in real time.

Who is this tool best suited for?

Novice to Intermediate investors that needs some level of financial interpretation to understand whether a particular news is bullish or bearish.

Value Hunter's Watchlist Brief flips this model by tracking events first, summarizing them immediately, and allowing users to interpret the signal without editorial framing.

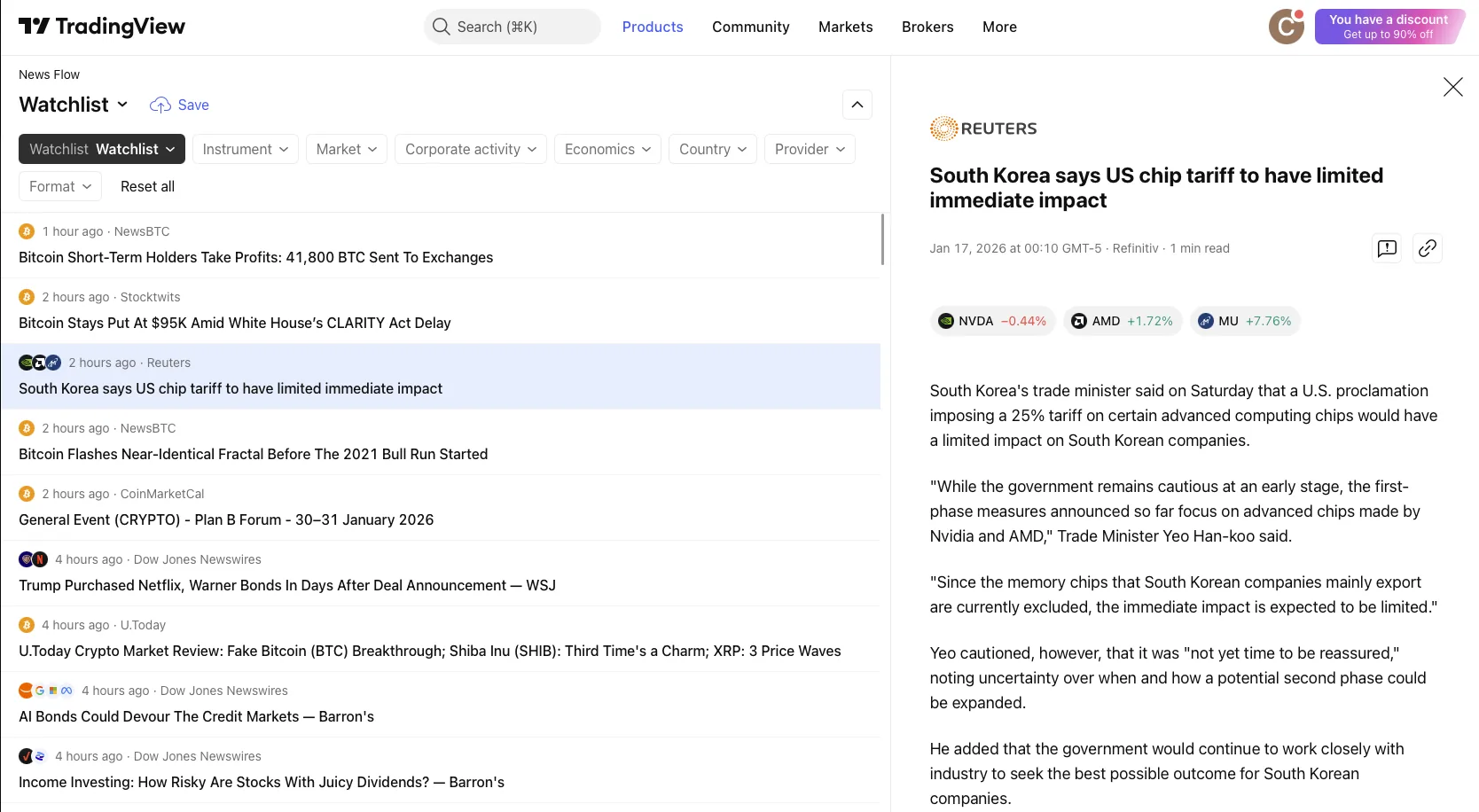

TradingView News Flow: Raw and Unfiltered

Just a typical news aggregator without any means to simplify stock research

Their Approach

- Aggregates headlines from multiple providers

- Displays them in a chronological stream

While useful for surface-level awareness, the experience quickly becomes overwhelming for investors managing multi-stock watchlists.

Where it falls short

- No theme detection

- No importance ranking

- No bullish/bearish indicators

- No company-specific historical context

This forces users to mentally process everything themselves. Creating information overload.

Who is this tool best suited for?

Intermediate to Professional investors that needs quick and latest news. Inidividuals that are already able to decipher clear signals from headlines. Highly benefiting active traders that makes decisions based on volatility and swings.

Value Hunter's Watchlist Brief doesn’t just show what happened—it explains why it matters.

StockNews.ai: Similar Concept, Narrower Value

no intelligence layer to tie the importance of news back to financials

StockNews.ai shares a similar idea: AI-driven summaries and watchlist-based alerts.

Their Approach

- AI-generated stock news summaries

- Watchlist-based alerts

Where it falls short

- Focused almost entirely on news

- Earnings are missed unless a news outlet covers it

- Limited functionality beyond news coverage

- Limited information and coverage for smaller cap companies

- Higher price point for the limited value proposition

The platform focuses almost exclusively on news, without deeper integration into earnings analysis, fundamentals, or long-term company performance. Basically if a news outlet isn't covering the topic, there is no information that would flow into this application.

Who is this tool best suited for? A complementary tool on top of your existing research application. Not recomended as a primary research tool

Value Hunter's Watchlist Brief goes further by integrating earnings summaries, earnings call insights, press release analysis, financial health metrics, growth trends, and valuation context—bringing the entire research workflow into one platform.

In short, StockNews.ai solves a one slice of the problem. Value Hunter solves the entire stock research workflow.

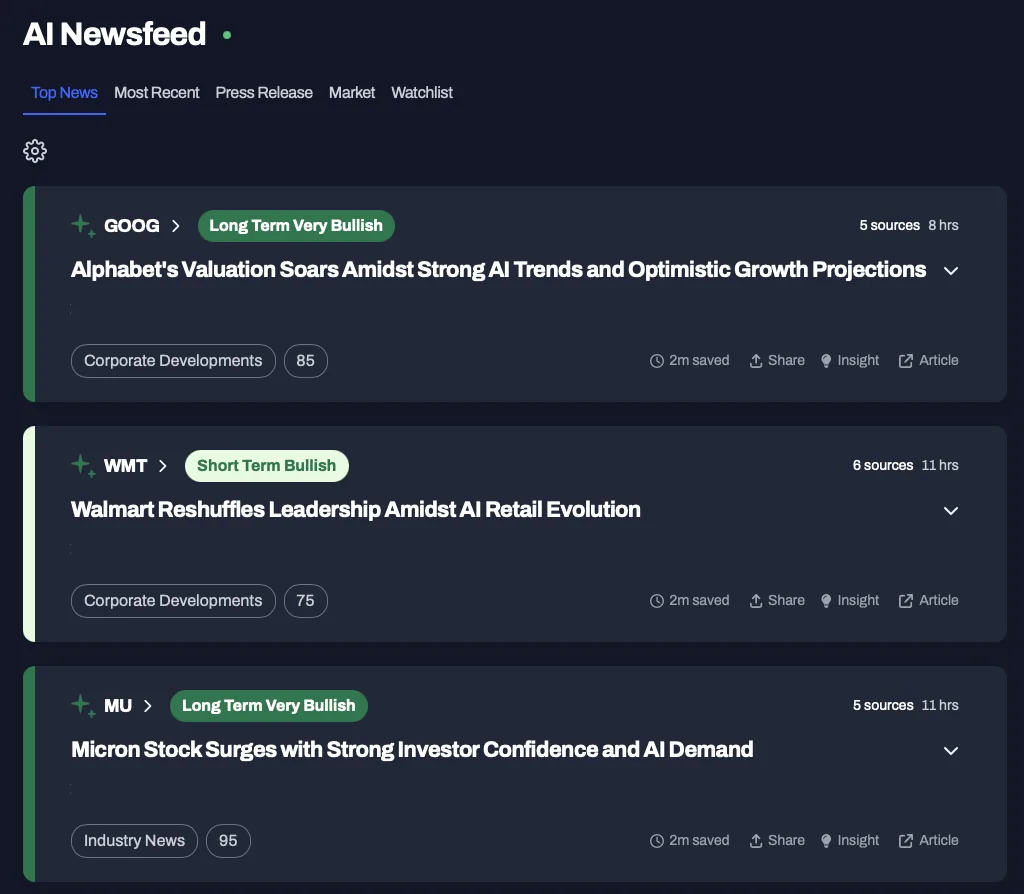

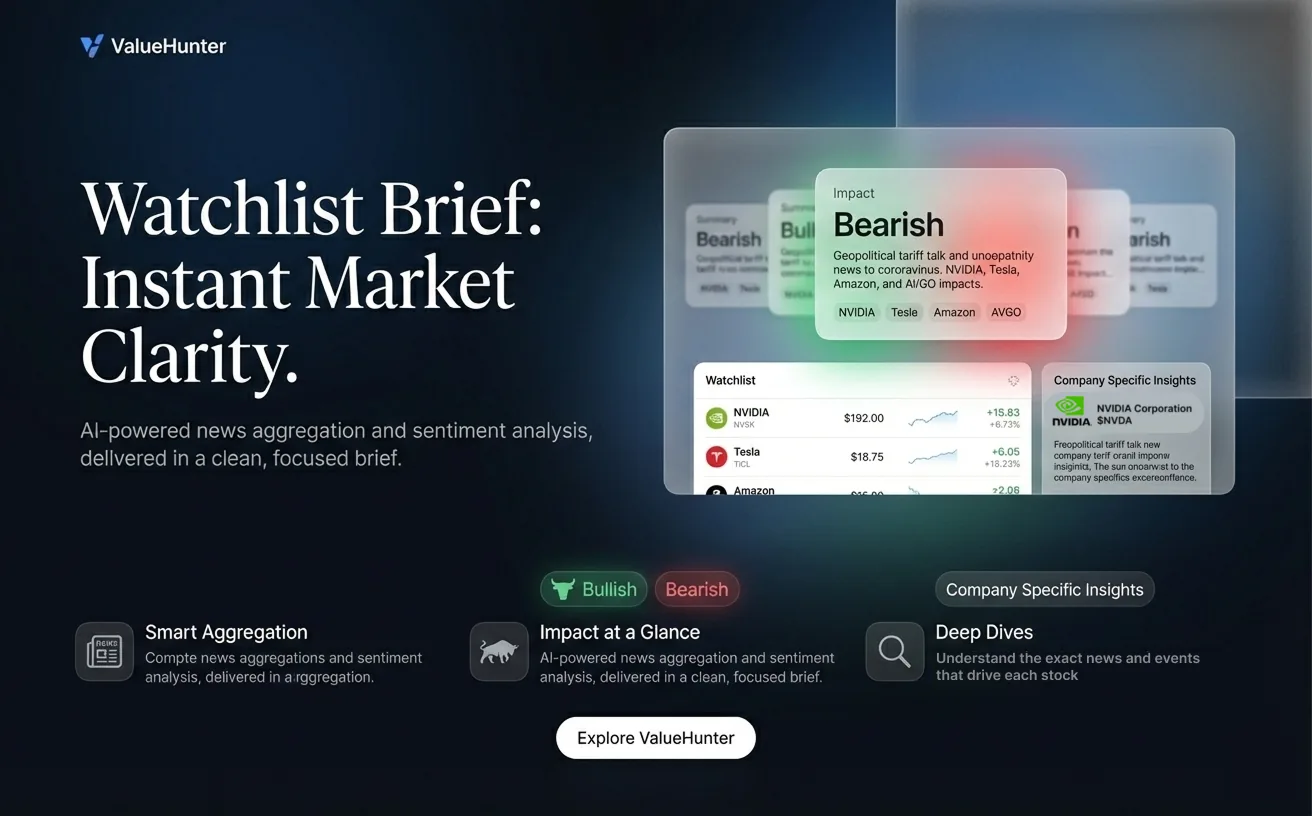

Value Hunter's Watchlist Brief - Institutional Level Synthesis for the Everyday Investor

Watchlist Brief is an AI-powered aggregation layer that continuously monitors news, filings, earnings, and company updates based on the stocks you care about.

Rather than dumping raw headlines into a feed, Watchlist Brief synthesizes information into something investors can actually use. News is grouped into themes, key events are highlighted, and each update is classified by impact—bullish, bearish, or neutral—while remaining grounded in company-specific context such as fundamentals, earnings history, and performance trends.

Why Value Hunter’s Watchlist Brief Is Different

🧭 Signal-first, not headline-first.

Instead of listing everything, Watchlist Brief identifies what actually changed, groups related updates into a single narrative, and surfaces material events investors should care about. This dramatically reduces cognitive load.

🧠 Built-in context and historical awareness.

Every summary considers prior earnings, guidance, known risks, and historical trends. News is never presented in isolation.

📈 Clear impact classification.

Each key update is labeled as bullish, bearish, or neutral. This doesn’t replace investor judgment—it accelerates it.

⚡ Speed without sacrificing accuracy.

Because Watchlist Brief doesn’t rely on human-written articles, updates surface immediately. You don’t wait for analyst coverage, and you don’t miss important developments.

🌐 Removes bias through multi-source aggregation.

Watchlist Brief aggregates news from multiple independent sources instead of relying on a single publisher or analyst. By interpreting overlapping facts across sources, the AI surfaces a clearer, more balanced signal—without editorial bias or opinion-led framing.

✔️ Built on trusted sources, not social media noise.

Watchlist Brief prioritizes established financial news outlets, company disclosures, earnings releases, and regulatory filings. It intentionally avoids social media-driven signals, ensuring higher accuracy, fewer false positives, and insight grounded in verified information.

🧩 One platform, end-to-end research.

Watchlist Brief is part of a broader ecosystem that includes company deep dives, earnings and transcript summaries, financial health analysis, and growth and valuation insights—eliminating the need to juggle multiple tools.

Who Watchlist Brief Is Built For?

Watchlist Brief isn't a day-trading terminal with millisecond execution like Bloomberg terminal.

It is designed for long-term investors managing multi-stock portfolios, professionals who need fast signal detection, and anyone tired of context switching between platforms. It’s especially valuable for investors who prioritize clarity, trust, and relevance over raw volume.

Internal Resources to Explore Next

Conclusion: The Smarter Way to Stay Informed

Most platforms either overwhelm you with data or slow you down with opinion.

Value Hunter’s Watchlist Brief does neither.

It delivers the right information, at the right time, with the right context.

If your goal is to make better, faster, and more confident investment decisions, Watchlist Brief isn’t just another news feed—it’s your trusted aggregation layer.