How to find undervalued stocks

Learn how to find undervalued companies using Value Hunter’s screener and scoring algorithm. Identify high-ROI stocks with strong fundamentals and lower risk.

How to Find Undervalued Stocks Using Value Hunter’s Screener

Finding undervalued stocks is one of the most common goals in investing, and yet it remains one of the most misunderstood areas of stock research. Many investors rely on surface-level metrics like low P/E ratios or discounted price-to-book values, only to discover later that a stock was cheap for a reason.

Value Hunter was designed to solve this exact problem.

Instead of defining undervaluation using a single metric, Value Hunter evaluates companies using a multi-factor scoring algorithm that balances valuation with financial strength, operational efficiency, and future growth potential. This approach helps investors identify companies that are priced attractively, but also fundamentally sound and positioned for long-term upside.

This guide explains how to find undervalued stocks using Value Hunter’s Screener, and how to validate those opportunities using the platform’s integrated research tools.

Understanding How Value Hunter Defines “Undervalued”

Before using the screener, it’s important to understand what undervalued means in the context of Value Hunter.

Traditional stock screeners typically label a company as undervalued if it trades at a discount based on:

- Low valuation multiples

- Historical price discounts

- Peer-relative pricing

While these signals are useful, they are incomplete. A company can appear cheap while suffering from:

- Weak balance sheets

- Declining margins

- Poor capital allocation

- Deteriorating growth prospects

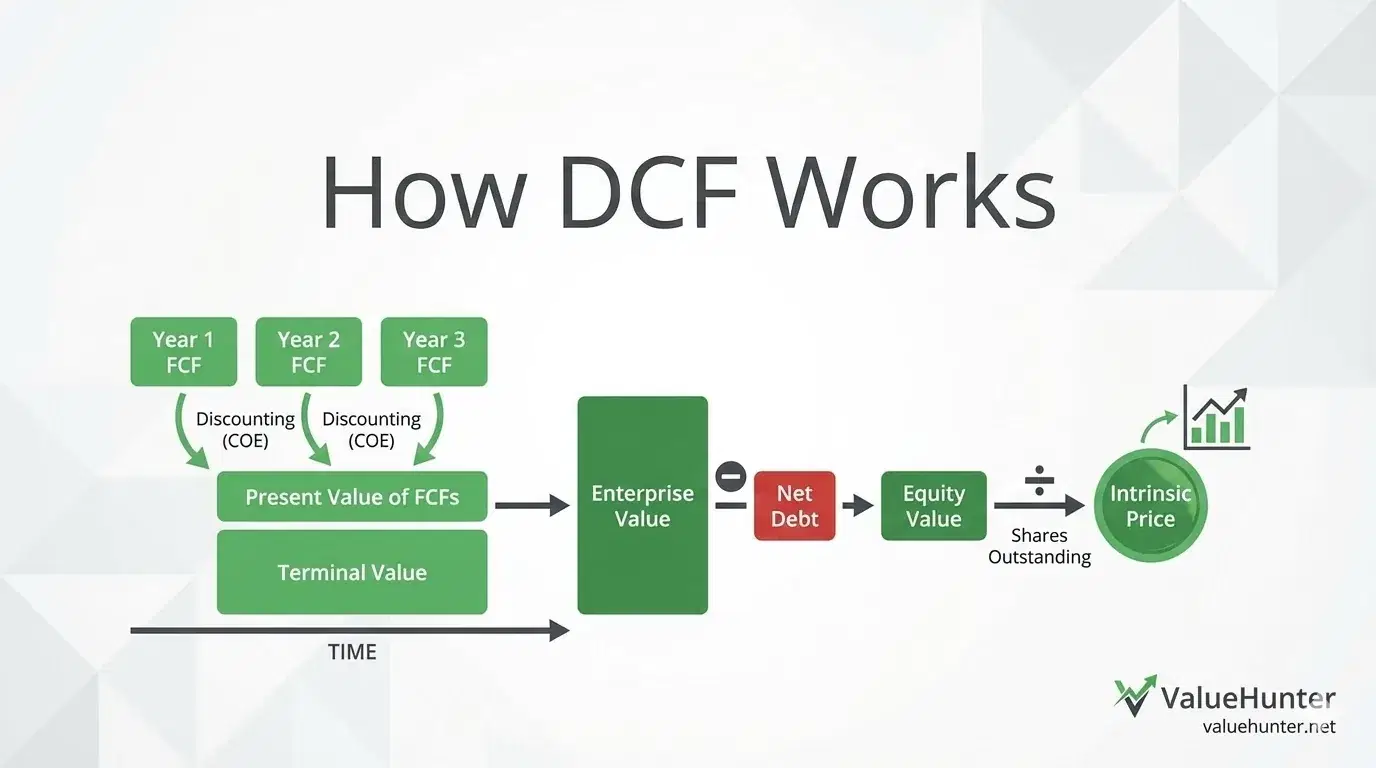

Value Hunter’s Scoring Framework

Value Hunter evaluates companies across four core dimensions:

- Valuation

- Financial Strength

- Efficiency

- Future Growth Potential

Each category is scored independently and then combined into a composite score. This allows users to filter companies based on quality-adjusted undervaluation, not just price.

Anything higher than a 4 in OVERALL SCORE indicates an undervalued opportunity that warrants further research - It is important to note that perfect scores are rare given the Market will already have priced in to the evaluations.

For a detailed breakdown of how each score is calculated, refer to:

Step 1: Open the Value Hunter Screener

The fastest way to identify undervalued companies is through the Value Hunter Screener.

The screener allows users to:

- Filter by industry

- Adjust scoring thresholds

- Instantly generate a ranked list of companies

All screener filters are directly tied to Value Hunter’s scoring algorithm, ensuring consistency between screening and deeper analysis.

Step 2: Filter by Industry

On the left-hand side of the screener interface, users can select one or more industries, including:

- Technology

- Financial Services

- Healthcare

- Energy

- Consumer Cyclical

- Consumer Defensive

- Industrials

- Real Estate

- Utilities

Why Industry Filtering Matters

Valuation benchmarks vary significantly across industries. A technology company trading at 25× earnings may be undervalued, while a utility trading at the same multiple may be overvalued.

Filtering by industry ensures:

- More accurate valuation comparisons

- Cleaner peer analysis

- Higher signal-to-noise ratio

Best practice:

Start with industries you understand or actively follow. This improves both screening accuracy and conviction during deeper research.

Step 3: Adjust the scores to Identify Undervaluation

Value Hunter’s screener uses horizontal sliders that directly map to the scoring algorithm, allowing users to filter companies based on both valuation and quality.

Setting the Undervaluation Threshold

To find undervalued companies, adjust the Valuation slider to a score above 4.

A valuation score above this threshold typically indicates that:

- The company is trading at a discount relative to its fundamentals

- Multiple valuation metrics point toward mispricing

- The market may be underestimating the company’s true value

Because Value Hunter aggregates multiple valuation inputs into a single score, this approach eliminates the need to manually screen by individual ratios such as P/E or EV/EBITDA.

Filtering for Quality and Risk Control

Undervaluation alone is not sufficient. Many companies are cheap because they face structural challenges or deteriorating fundamentals.

To avoid value traps, Value Hunter allows users to layer in quality filters by adjusting the remaining scoring sliders:

Financial Strength helps ensure balance sheet stability and downside protection

Guidance:

- Avoid combining extreme undervaluation with weak financial strength

- Prioritize companies that can survive and compound over multiple cycles

By setting a minimum threshold for financial strength, users filter out:

- Highly leveraged companies

- Firms dependent on external financing

- Businesses vulnerable to economic downturns

Efficiency highlights companies that deploy capital effectively and maintain strong margins

Including efficiency in your screener helps identify companies that are not only undervalued, but also well-run.

Efficient companies tend to:

- Generate higher returns on invested capital

- Maintain margins during downturns

- Scale more predictably

Future Growth filters for businesses with credible paths to earnings expansion This score is particularly important for avoiding value traps—companies that are cheap because their growth prospects are permanently impaired.

Filtering for strong scores across these categories helps surface companies that combine attractive pricing with durable fundamentals.

The most compelling opportunities typically score well across all four dimensions, creating the potential for high returns with reduced downside risk.

This combination creates asymmetric upside with controlled downside risk.

Step 4: Review the Screened Company List

Once all filters are applied, Value Hunter generates a ranked list of companies that meet your criteria.

Compared to traditional stock screeners, this list is:

- Smaller

- More focused

- Higher quality

Each company has already passed multiple fundamental checks, allowing you to move efficiently into deeper research.

Step 5: Conduct Deep Company Research in Value Hunter

Clicking into a company opens the Company Overview, where Value Hunter consolidates all relevant analysis in one place.

Key Areas to Review

1. Undervaluation Breakdown

Value Hunter explains:

- Which metrics contribute most to the valuation score

- How the company compares to industry peers

- Why the market may be mispricing the business

This helps determine whether the undervaluation is temporary or structural.

2. Earnings Calls and Earnings Reports

Value Hunter analyzes:

- Recent earnings calls

- Management commentary

- Changes in guidance

- Strategic priorities

Tracking these trends helps investors understand:

- Management credibility

- Execution consistency

- Forward-looking risks and opportunities

3. Latest News and Market Developments

All relevant news is aggregated to provide context around:

- Regulatory changes

- Industry shifts

- Company-specific catalysts

This is especially useful for identifying events that could trigger a re-rating.

4. Forward Financial Projections

Value Hunter’s projections help assess:

- Expected revenue growth

- Margin trends

- Earnings trajectory

This enables investors to evaluate whether the current valuation adequately reflects future performance.

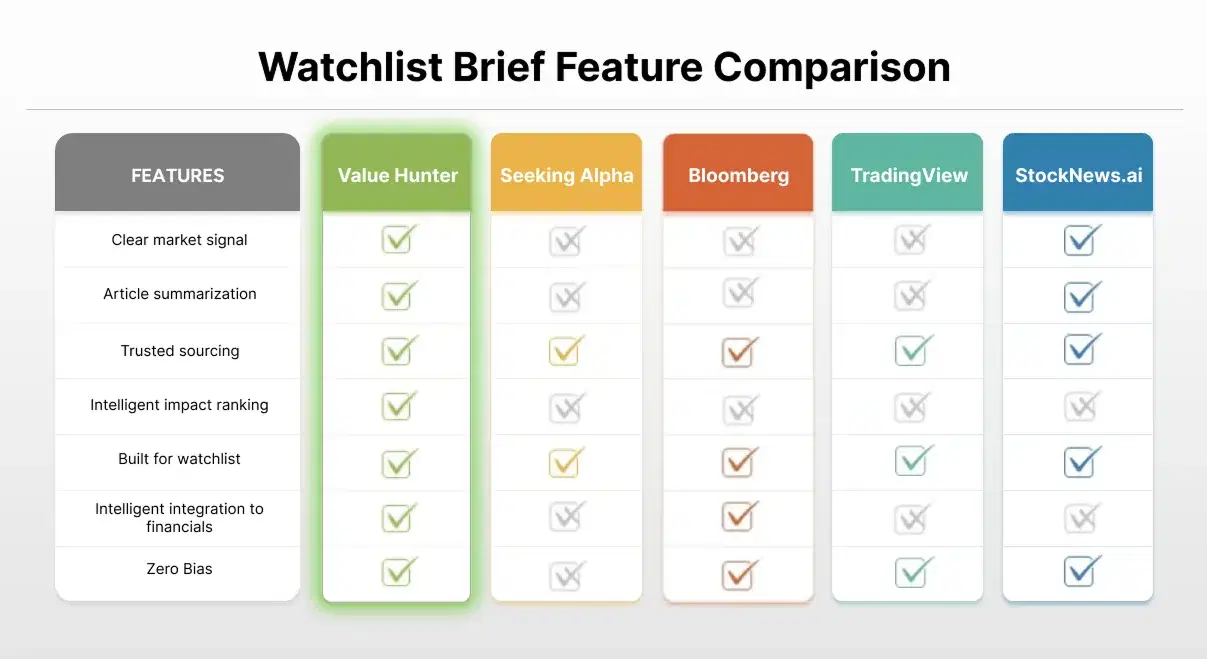

Why Value Hunter’s Approach Is Superior to Traditional Screeners

Compared to platforms like Seeking Alpha, Simply Wall Street, TIKR, Fiscal.ai, and Alpha Spread, Value Hunter offers:

- A unified scoring system across valuation and fundamentals

- Algorithm-driven screening instead of manual ratio filters

- Seamless transition from screening to deep research

- Reduced cognitive overload and decision fatigue

Rather than chasing cheap stocks, users systematically identify high-quality undervalued companies.

Summary: A Disciplined Framework for Finding Undervalued Stocks

Finding undervalued stocks requires more than spotting low multiples. It requires understanding why a stock is cheap and whether that mispricing is justified.

By using Value Hunter’s:

- Industry filters

- Valuation score above 4

- Financial strength, efficiency, and growth sliders

- In-depth company analysis tools

Investors can build a repeatable, data-driven process for identifying opportunities with strong upside potential and lower downside risk.

Next Step

Use Value Hunter’s Screener to start identifying undervalued companies that meet your investment criteria—and validate them with comprehensive, fundamental research in one platform.