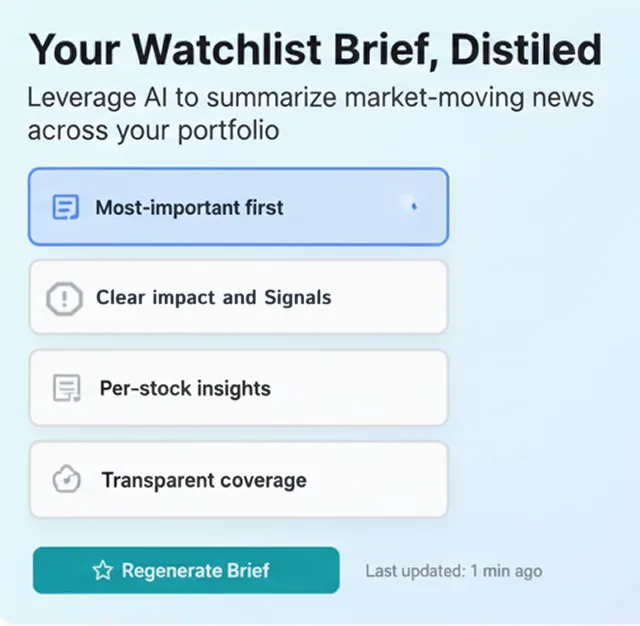

Watchlist Brief a Trusted Stock News Aggregator

Discover why Watchlist Brief by Value Hunter is a trusted source for stock watchlist news—powered by vetted sources, AI-driven relevance detection, impact analysis, and real-time market context.

In modern investing, access to information is no longer the problem.

Trust is.

Every investor today has unlimited news at their fingertips. Headlines are everywhere. Opinions are endless. Yet confidence in decision-making feels harder than ever. When every platform shows you more content, it becomes increasingly difficult to answer a simple question:

Which information actually matters—and can I trust it?

This article explains why Watchlist Brief by Value Hunter is built to solve that exact problem. Not by showing you more headlines, but by delivering accurate, relevant, and timely signals you can rely on.

TLDR:

- Watchlist Brief pulls news only from trusted, reputable financial sources, ensuring credibility from the start.

- Many headlines are written to grab attention, often exaggerating events that have little to no real impact on a stock.

- Value Hunter’s AI focuses on actual material impact, not headline drama—identifying which developments truly matter.

- Human bias and subjective interpretation can be misleading or outright wrong, especially when taken out of context.

- By factoring in recency, relevance, and market context, Watchlist Brief filters out noise and delivers more accurate, trustworthy signals.

The Real Trust Problem in Stock Research

Most investors don’t struggle because they lack data. They struggle because the data is fragmented, repetitive, and often misleading.

You might see the same story repeated across multiple websites, rewritten with different headlines, framed with different opinions, and sometimes resurfacing days—or even weeks—after it was first relevant. The result is confusion, not clarity.

Trust breaks down when:

- News feels contradictory

- Commentary blurs the line between fact and opinion

- Old information is presented as new

- Important developments are buried under noise

Watchlist Brief was designed specifically to fix this.

Built on Trusted, High-Quality News Sources

Trust begins with the source of the information.

Watchlist Brief aggregates stock-related news only from well-established and widely respected financial publications, including:

Reuters, Financial Times, CNBC, MarketWatch, Forbes, and Benzinga.

These are not random blogs, social media posts, or anonymous commentary. They are professional newsrooms with editorial standards, fact-checking processes, and institutional credibility.

By starting with trusted sources, Watchlist Brief immediately eliminates a major source of misinformation that plagues many other stock research platforms.

Why Aggregation Alone Is Not Enough

Many tools claim to “aggregate” financial news. In reality, they simply collect links and place them in a feed.

Aggregation without intelligence creates a new problem: overload.

Seeing ten similar headlines does not make you more informed—it makes you more uncertain. Watchlist Brief goes further by understanding what the news actually means, not just where it came from.

How AI Determines What’s Actually Relevant

Not every headline deserves your attention.

A minor product update should not carry the same weight as an earnings revision, regulatory action, or major strategic shift. Watchlist Brief uses AI models that analyze:

- How frequently a company is mentioned across trusted sources

- Whether coverage is increasing or fading

- The language used to describe the event

- How the story fits into recent company history

When multiple reputable outlets independently cover the same development, relevance increases. When a story appears once and disappears, it fades into the background.

This ensures that you see what matters now, not everything that exists.

Trust Problem 1 - Way Too Much Noise

One of the biggest frustrations in stock research is redundancy.

You may encounter the same story repeated across multiple sites, each framed slightly differently but offering no new information. Or some catchy headline that takes your attention. This repetition creates false urgency and wastes time.

Watchlist Brief detects overlapping articles and consolidates them into a single, clear insight. Instead of reading ten versions of the same news, you see one concise summary that highlights what is new, what has changed, and why it matters.

This approach dramatically reduces cognitive overload and builds trust through clarity.

When Big Headlines Don’t Mean Big Impact

Not all news that sounds important actually is.

A common example investors see is insider trading headlines—especially insider selling. These headlines often look alarming at first glance, even when the underlying facts tell a very different story.

A Realistic Example

Imagine the following headline:

“CEO Sells $1 Million Worth of Company Stock”

At face value, this can trigger concern. Investors may wonder if leadership is losing confidence or preparing for bad news. But context matters.

Now consider the full picture:

- The company has a $100 billion market capitalization

- The CEO owned $20 billion worth of shares before the sale

- The sale represents 0.005% of the company’s total market value

- The CEO still owns over $19.999 billion in stock after the transaction

In practical terms, this sale is financially insignificant.

It could reflect routine diversification, tax planning, or pre-scheduled selling under a 10b5-1 plan—none of which change the company’s fundamentals, outlook, or competitive position.

Why This Type of News Is Often Immaterial

Despite how dramatic the headline appears, this kind of event typically has:

- No impact on revenue, earnings, or cash flow

- No change to business strategy

- No new information about future performance

- No meaningful signal of insider confidence shifting

Yet many platforms surface these stories prominently, simply because insider activity attracts clicks.

How Watchlist Brief Handles This Differently

Watchlist Brief doesn’t treat every headline as equal.

The AI evaluates:

- The size of the transaction relative to market cap

- The insider’s remaining ownership

- Historical patterns of insider transactions

- Whether similar activity has occurred without market impact

In this example, the system would recognize that:

- The transaction is immaterial

- Coverage volume is low or routine

- There is no broader market reaction

- The appropriate signal is neutral

Instead of elevating noise, Watchlist Brief filters it out—or clearly labels it as non-impactful.

Why This Builds Trust

Investors lose trust when platforms amplify headlines that don’t matter.

By distinguishing between what sounds big and what actually is big, Watchlist Brief helps you stay focused on developments that can truly move a stock—while ignoring those that shouldn’t.

This is how clarity replaces overreaction, and why relevance matters more than volume.

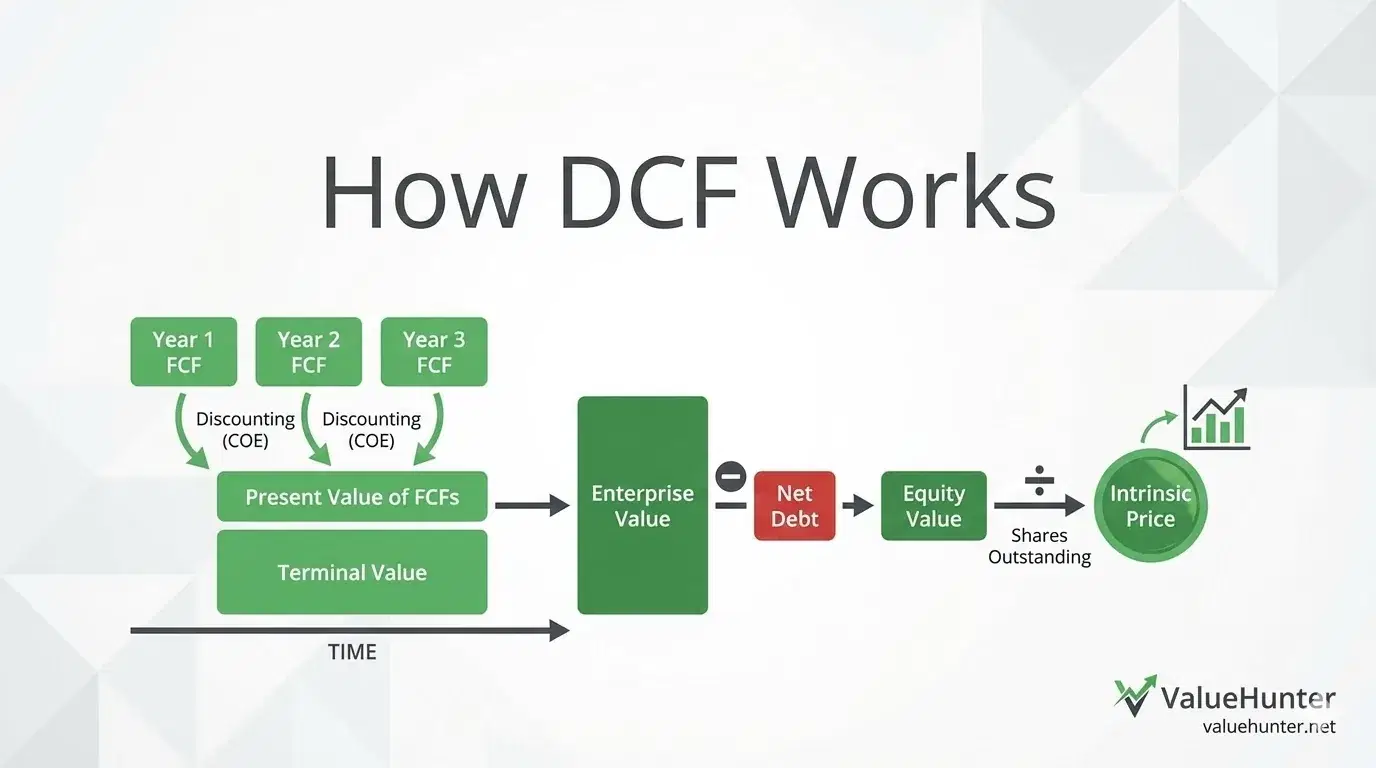

Most platforms answer the question: What happened?

Watchlist Brief answers a more important one:

Does this change anything for the stock?

The AI evaluates the potential impact of news by considering factors such as:

- Financial significance

- Operational consequences

- Regulatory implications

- Historical market reactions to similar events

This allows the system to distinguish between news that is merely interesting and news that is genuinely market-moving.

Trust Problem 2 - Bias and Interpretation

Human commentary can be useful—but it is also inconsistent.

Analyst opinions, contributor articles, and community discussions often reflect personal bias, incentives, or emotional reactions. Two people can read the same news and reach completely opposite conclusions.

Watchlist Brief removes this inconsistency by relying on pattern-based analysis rather than individual opinions. The system looks at how similar news has historically affected markets and companies, providing a more stable and repeatable interpretation.

This consistency is critical for trust.

Clear Bullish, Bearish, or Neutral Signals

Investors should not have to guess how to interpret a headline.

Watchlist Brief provides a clear signal—bullish, bearish, or neutral—based on the overall tone, relevance, and expected impact of the news.

Importantly, neutral is treated as a meaningful outcome. Not all news requires action, and not all developments meaningfully change a company’s outlook. By acknowledging this, Watchlist Brief avoids forcing narratives where none exist.

Seeing Market-Wide and Portfolio-Level Effects

Stocks do not move in isolation.

Interest rate decisions, inflation data, geopolitical developments, and economic reports often affect entire sectors—or even the whole market. Watchlist Brief identifies market-wide news and explains how it may influence individual stocks in your watchlist.

This helps investors understand:

- Why multiple holdings may move together

- How macro events translate into company-level impact

- Whether a move is stock-specific or market-driven

Context builds confidence. Confidence builds trust.

Accounting for Economic and Macro Factors

Many platforms surface macroeconomic headlines without explaining why they matter.

Watchlist Brief evaluates economic data such as inflation reports, employment figures, central bank decisions, and commodity movements. It then assesses how these factors interact with specific companies and sectors.

This prevents overreaction to headlines while ensuring that important macro signals are not ignored.

Accuracy Through Recency and Context

Outdated information is one of the most dangerous traps in investing.

Articles can linger in search results long after conditions have changed. Old narratives can persist even when they are no longer relevant.

Watchlist Brief prioritizes the most recent developments and continuously adjusts relevance as new information emerges. When a situation evolves, the signal evolves with it.

This focus on recency ensures that decisions are based on what is true now, not what used to be true.

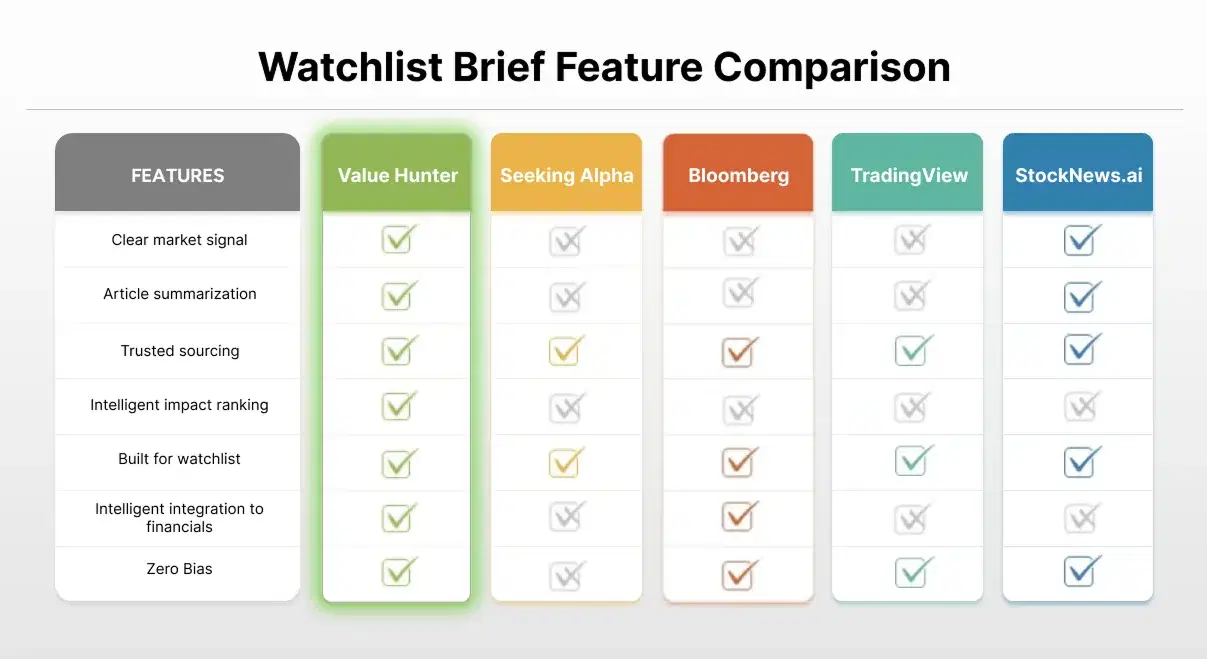

Why This Builds More Trust Than Traditional Platforms

Many popular research platforms emphasize:

- Opinion-driven analysis

- Community sentiment

- Engagement metrics

Watchlist Brief emphasizes:

- Source credibility

- Relevance

- Impact

- Consistency

It does less—but does it better.

Trust Is Earned Through Discipline

Watchlist Brief does not promise perfect predictions or guaranteed returns. Instead, it offers something more valuable: a reliable framework for understanding what matters.

By combining trusted sources, intelligent aggregation, relevance detection, and impact analysis, Watchlist Brief earns trust over time—through accuracy, not hype.

Experience the Difference Yourself

The best way to understand why Watchlist Brief is trustworthy

is to experience how it changes the way you follow your watchlist.

Let the noise fade. Let the signals stand out.

👉 Try Watchlist Brief by Value Hunter