How ValueHunter’s Levered DCF Model Calculates Intrinsic Value

This post explains the internals and details of the DCF model that we use

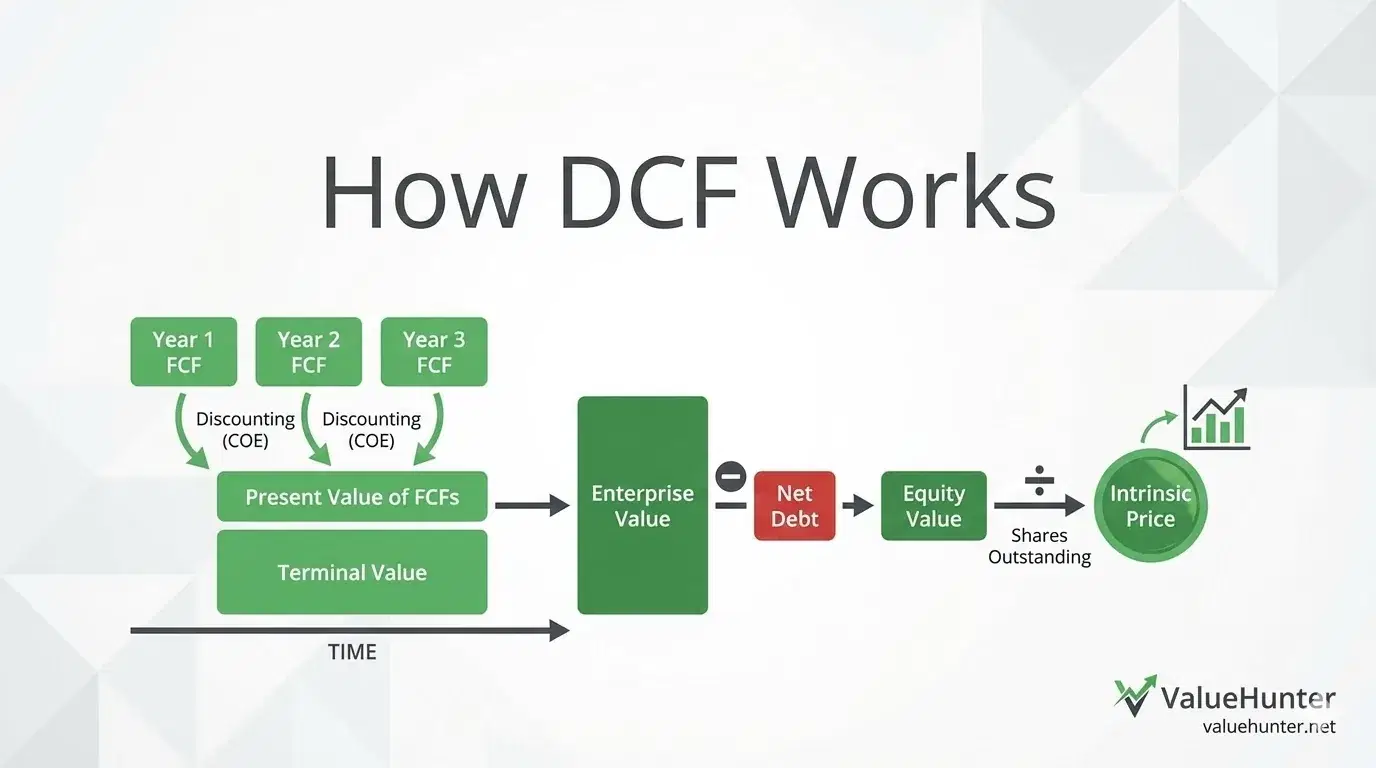

How does the Discounted Cash Flow (DCF) model work?

The DCF model helps value investors determine the intrinsic value of a stock. It estimates the value of a company based on the cash it is expected to generate in the future, adjusted for the time value of money. Our model specifically uses the Levered DCF approach.

Why Levered DCF?

When valuing a company, it is important to consider the company's debt levels. Debt can significantly impact a company's financial performance and value. Our Levered DCF model accounts for debt by discounting the company's expected future cash flows to their present value after taxes and debt payments. This approach provides a more accurate picture of the company's true value for equity holders.

1. Inputs: What do we need?

To use the Levered DCF model, we need the following data:

- Free Cash Flow (FCF): The cash the company generates after accounting for operating expenses, taxes, and debt payments.

- Cost of Equity (COE): The return expected by equity investors.

- Long-Term Growth Rate: The expected growth rate of cash flows after the projection period.

- Net Debt: The company's total debt minus its cash.

- Shares Outstanding: Total number of company shares.

2. Steps in the calculation

Step 1: Discount Future Cash Flows

Future free cash flows are discounted back to today's value using the Cost of Equity (COE).

Formula:

Present Value of FCF = FCF for Year n / (1 + COE)^Years to Discount

Step 2: Calculate Terminal Value

This estimates the value of all cash flows beyond the projection period.

Formula:

Terminal Value = Last Year's FCF × (1 + Long-Term Growth Rate) / (COE - Long-Term Growth Rate)

Step 3: Add Up the Values

Add the discounted cash flows and the terminal value to get the Enterprise Value (the value of the entire company).

Step 4: Subtract Net Debt

Subtract the company's net debt to calculate the Equity Value (the value for shareholders).

Step 5: Divide by Shares Outstanding

Divide the equity value by the number of shares to get the Intrinsic Price Per Share.

3. Result: The Intrinsic Price

The Levered DCF model provides the intrinsic price per share of the company's stock. If this price is higher than the current stock price, the stock may be undervalued (a potential buy).

4. Key Considerations

- Accuracy of Inputs: The result depends heavily on accurate inputs (e.g., FCF, COE, growth rate).

- Realistic Growth Rates: The long-term growth rate must be lower than COE; otherwise, the formula won't work.

- Debt Impacts: Because we account for debt, companies with high debt levels will have lower intrinsic values.

- Negative or Zero Cash Flow: If cash flow is consistently negative or zero, the model won't provide a meaningful result.

Example

Let's say a company has:

- FCFs: $100M (Year 1), $110M (Year 2), $120M (Year 3)

- COE: 10%

- Long-Term Growth Rate: 3%

- Net Debt: $50M

- Shares Outstanding: 10M

Using the Levered DCF model, the intrinsic price might calculate to $15.50 per share. If the stock is currently trading at $10, it might be undervalued.

If you have any feedback, questions, or suggestions on the Levered DCF model, we would love to hear them!

Drop me a line at contact@valuehunter.net